The measure of money inflows and outflows between the US and the rest of the world (ROW)

- Inflows are referred to as credits

- Outflows are referred to as debits

- Current Account

- Capital/Financial Account

- Official Reserves Account

|

Balance of Trade or Net Exports

- Exports of Goods and Services (G&S)

- Exports create a credit to the balance of payments

- Imports create a debit to the balance of payments

- Net Foreign Income

- Income earned by US owned foreign assets - Income paid to foreign held US assets.

- Example: Interest payments on US owned Brazilian bonds - Interest payments on German owned US treasury bonds.

- Net Transfers (tend to be unilateral)

- Foreign aid ➝ a debit to the current account

- Example: Mexican migrant workers send money to family in Mexico.

The balance of capital ownership.

- Includes the purchases of both real and financial assets

- Direct investment in the US is a credit to the capital account.

- Ex. Toyota factory in San Antonio

- Direct investment by US firms/individuals in a foreign country are debits to the capital account.

- Ex. The Intel factory in San Jose, Costa Rica

- Purchase of foreign financial assets represents a debit to the capital account

- Ex. Warren Buffet buys stocks in Petrochina

- Purchase of domestic financial assets by foreigners represents a credit to the capital account.

- Ex. The United Arab Emirates Sovereign Wealth Fund purchases a large stake in the NASDAQ

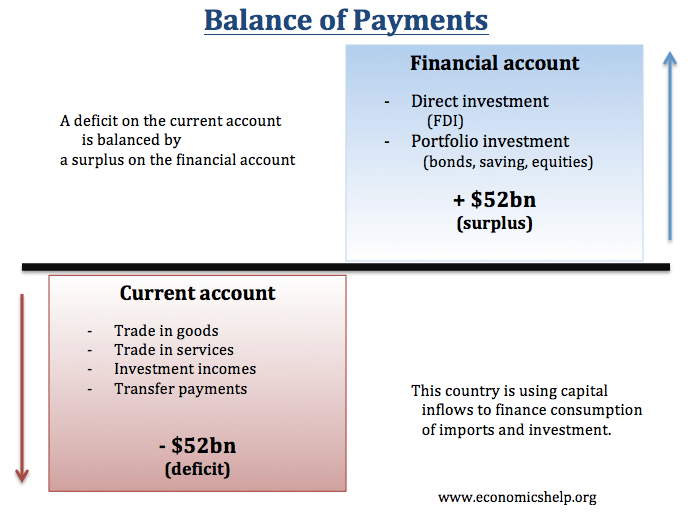

- Relationship between Current and Capital Account

- The current account and the capital account should zero each other out.

- That is...if the current account has a negative balance (deficit), then the capital account should then have a positive balance (surplus)

The foreign currency holdings of the US Federal Reserve System

- When there is a balance of payments surplus the Fed accumulates foreign currency and debits the balance of payments.

- When there is a balance of payments deficit the Fed depletes its reserves of foreign currency and credits the balance of payments.

- The official reserves zero out the balance of payments.

Formulas

- Balance of trades

- Good exports + good imports

- Balance of Goods and Services

- (Goods exports + service exports) + (Goods imports + services imports)

- Current Account

- Balance of Goods and Services + Net investment income + Net transfers

- Capital Account

- Foreign purchases of assets + US purchase of assets

- Official Reserves

- Current Account + Capital Account