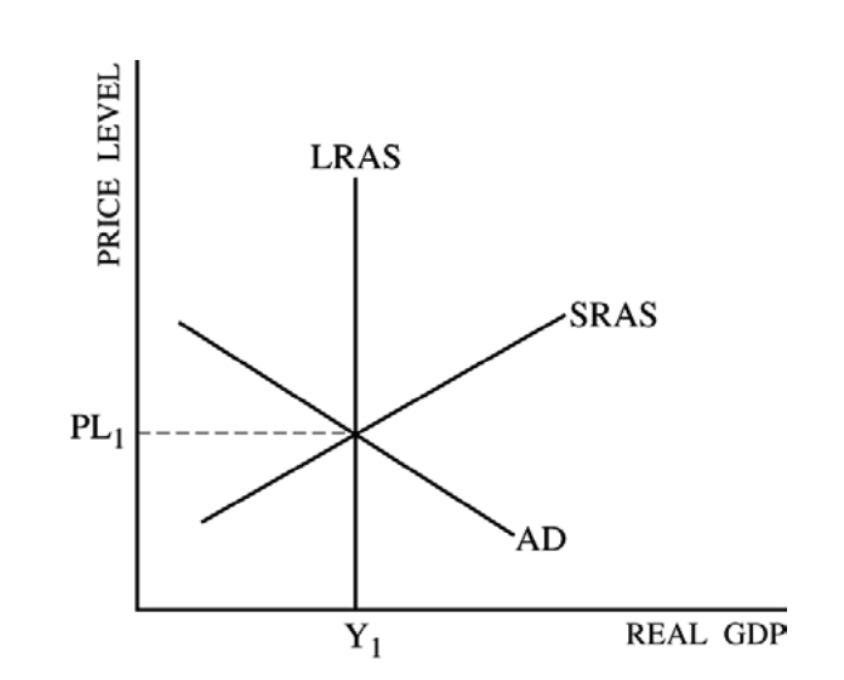

The equilibrium of AS and AD determines current output (GDPᵣ) and the price level.

Recessionary Gap

Exists when equilibrium occurs below full-employment output

Inflationary Gap

Exists when equilibrium occurs beyond full employment output.

Three Ranges of SRAS

1. Keynesian/horizontal range

- Occurs when we are in a recession or depression, not fully using all of our resources, and below full employment.

2. Intermediate-range

- Occurs when resources are getting closer to full employment levels, which creates upward pressure on wages and prices.

3. Classical or vertical range

- Occurs when real GDP is at a level below the full employment level, where any increase in demand will result only in an increase in prices.

Demand-pull inflation

- An increase in the average price level resulting from an increase in total spending in the economy

- C, Ig, G, and Xn make the AD in a nation.

- AD is always increasing.

Cost-push inflation

When firms respond to rising costs by increasing their prices to protect profit margins. It can be caused by the following:

- Rising unit labor costs

- Higher prices for important components/raw materials

- A depreciation in the exchange rate causing a rise in import costs

- An increase in business taxes(e.g. a value-added tax (VAT) or environmental taxes) such as a carbon tax

- Expectations in inflation rate

Some factors affecting inflationary pressures:

- Rising property prices → Increased consumer wealth →Demand-pull inflation risk

- Increasing world oil prices → Higher costs for businesses → Cost-push inflation risk

- Depreciating exchange rate → Increased import prices and rising exports → Cost-push and demand-pull inflation risk

- Rapid expansion of money and credit from banks → Rising consumer spending financed by loans → Demand-pull inflation risk

Why does SRAS have 3 different ranges?

ReplyDelete