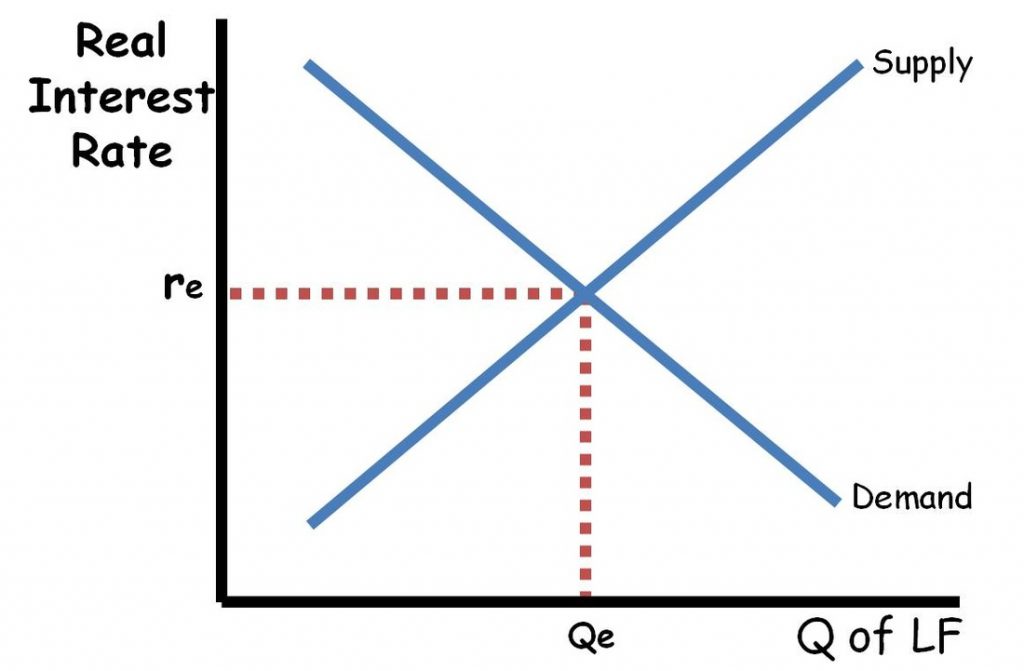

Loanable Funds Market

- The market where savers and borrowers exchange funds (QLF) at the real rate of interest (r%)

- The demand for loanable funds or borrowing comes from households, firms, government, and the foreign sector. The demand for loanable funds is in fact the supply of bonds.

- The supply of loanable funds, or savings comes from households, firms, government and the foreign sector. The supply for loanable funds is also the demand for bonds.

- Remember that demand for loanable funds = borrowing (ex. supplying bonds)

- More borrowing = More demand for loanable funds (➝)

- Less borrowing = Less demand for loanable funds (←)

- Government deficit spending = more borrowing = more demand for loanable funds

- DLF shifts to the right

- Real rate of interest (r%) goes up

- Less investment demand = less borrowing = less demand for loanable funds

- DLF shifts to the left

- Real rate of interest (r%) goes down

Changes in the Supply for Loanable Funds(SLF)

- Remember that supply of loanable funds = saving(ex. demand for bonds)

- More saving = More supply of loanable funds (➝)

- Less saving = Less supply of loanable funds (←)

|

- Government budget surplus = more saving = more supply of loanable funds

- SLF shifts to the right

- r% goes down

- Decrease in consumers' MPS = less saving = less supply of loananble funds

- SLF shifts to the left

- r% goes up

No comments:

Post a Comment