Fiscal policy: Changes in the expenditures or tax revenues of the federal government. It is enacted to promote our nation's economic goals: full employment, price stability, and economic growth.

Two tools of fiscal policy:

- Taxes: government can increase or decrease taxes

- Spending: government can increase or decrease spending

Deficits, Surpluses, and Debt

- Balanced budget

- Revenues = Expenditures

- Budget deficit

- Revenues < Expenditures

- Budget surplus

- Revenues > Expenditures

- Government debt

- Sum of all deficits - Sum of all surpluses

- The government must borrow money when it runs a budget deficit

- The government borrows from:

- Individuals

- Corporations

- Financial institutions

- Foreign entities or foreign governments

Fiscal Policy Two Options

- Discretionary fiscal policy (action)

- Expansionary fiscal policy- think deficit

- Contractionary fiscal policy- think surplus

- Non-discretionary fiscal policy (no action)

Discretionary vs. Automatic Fiscal Policies

Discretionary fiscal policies

- Increase or decreasing government spending and/or taxes in order to return the economy to full employment.

- It involves policymakers doing fiscal policy in response to an economic problem.

Automatic fiscal policies

- Unemployment compensation and marginal tax rates are examples of automatic policies that help mitigate the effects of recession and inflation.

- It takes place without policymakers having to respond to current economic problems.

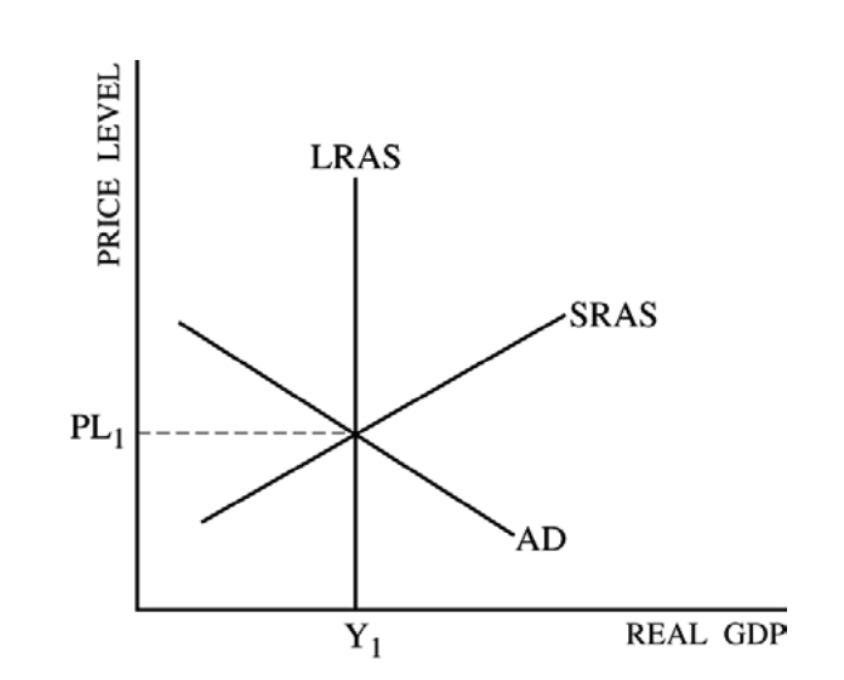

Expansionary fiscal policy

- Recession is countered with expansionary policy

- Increase in government spending (G ↑)

- Decrease in taxes (T ↓)

- The price level is increased: this means that expansionary fiscal policy creates some inflation.

Contractionary fiscal policy

- Inflation is countered with contractionary policy

- Decrease in government spending (G ↓)

- Increase in taxes (T ↑)

- The unemployment rate is increased: this means that contractionary fiscal policy creates some unemployment.

Weaknesses of Fiscal Policy

- Lags

- Inside lags take time to recognize economic problems and to promote solutions to those problems

- Outside lags take time to implement solutions to problems

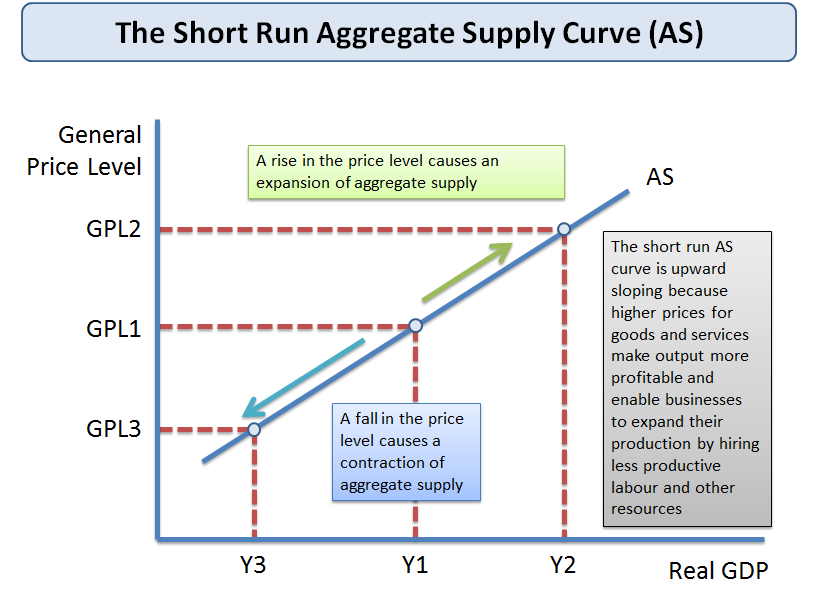

Supply Side Economics

- Stimulate production (supply) to spur output.

- Cut taxes and government regulations to increase incentives for businesses and individuals. Businesses invest and expand, creating jobs; people work, save, and spend more.

- An increase in investment and productivity lead to an increase in output.

Demand Side Economics

- Stimulate the consumption of goods and services (demand to spur output).

- Cut taxes or increase federal spending to put money into people's hands.

- With more money, people buy more.

- Businesses increase output to meet the growing demand.

Automatic or Built-In Stabilizers

- Anything that increases the government's budget deficit during a recession and increases its budget surplus during inflation without requiring explicit action by policymakers.

- Transfer Payments (a type of automatic stabilizers)

- Welfare checks

- Food stamps

- Unemployment checks

- Corporate dividends

- Social security

- Veteran's benefits

Tax Systems

- Progressive

- When the average tax rate (tax revenue/GDP) rises with GDP

- Proportional

- When the average tax rate remains constant as GDP changes

- Regressive tax systems.

- When the average tax rate falls with GDP