Labor force: number of people in a country that are classified as either employed or unemployed

Labor force is made up of

-Employed

-able and willing to work

-must be 16 years of age or older

-must work at least one hour every two weeks

-Unemployed

-people of 16 years age and older that do not have a job

Unemployment: the failure to use available resources, particularly labor, to produce desired goods and services

Underemployment: not using resources to best of ability

Unemployment rate: (Number of unemployed / Total labor force) x 100

-Total labor force: Number of employed + number of unemployed

-Ideal unemployment rate is 4 to 5%

Not in labor force

1.Students

2.Prisoners

3.Mental institution

4.Military

5.Disabled

6.People who have given up in looking for a job

7.Homemakers

8.Choose not to work

9.Retired people

Types of Unemployment

1.Frictional: People who are between jobs, temporarily unemployed.

Ex: High school/college graduates looking for a job, people who are fired and looking for a job, people looking for a job

-Total labor force: Number of employed + number of unemployed

-Ideal unemployment rate is 4 to 5%

Not in labor force

1.Students

2.Prisoners

3.Mental institution

4.Military

5.Disabled

6.People who have given up in looking for a job

7.Homemakers

8.Choose not to work

9.Retired people

Types of Unemployment

1.Frictional: People who are between jobs, temporarily unemployed.

Ex: High school/college graduates looking for a job, people who are fired and looking for a job, people looking for a job

2.Seasonal: Due to the time of the year and nature of the job

Ex: Lifeguards, bus drivers, construction workers, Santa

3.Structural: Changes in the structure of the labor force makes some skills obsolete. Workers don't have transferable skills.

Ex: High school dropout, VCR repairman

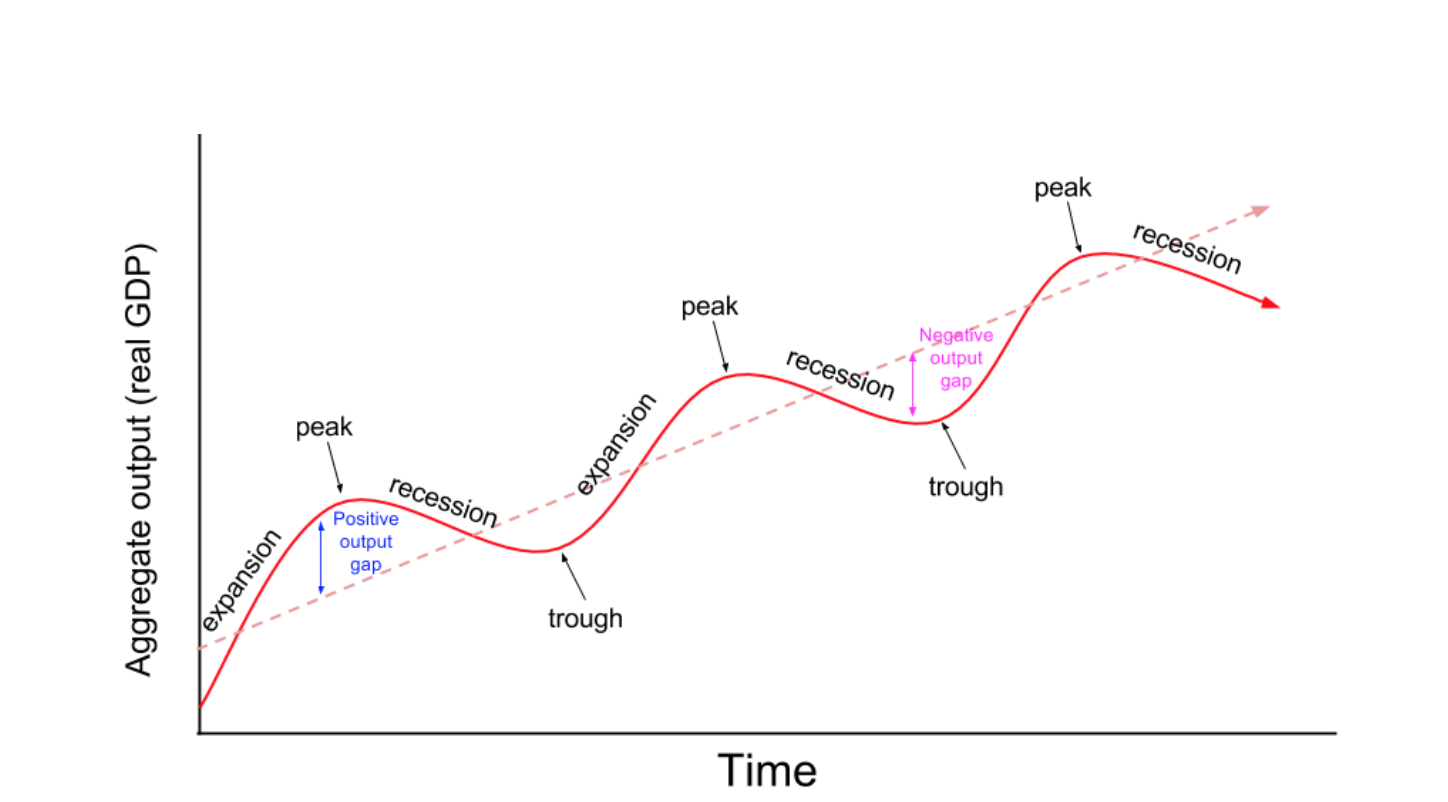

4.Cyclical: Results from economic downturns such as recessions. As demand for goods and services fall, demand for labor falls and workers are fired/laid off.

Rule of 70: Calculates approximate number of years to double GDP

Ex: Lifeguards, bus drivers, construction workers, Santa

3.Structural: Changes in the structure of the labor force makes some skills obsolete. Workers don't have transferable skills.

Ex: High school dropout, VCR repairman

4.Cyclical: Results from economic downturns such as recessions. As demand for goods and services fall, demand for labor falls and workers are fired/laid off.

- Frictional and structural unemployment can not be avoided

- Frictional + Structural = Natural Rate of Unemployment (NRU)

- Full employment means there's no cyclical unemployment

- Ideal unemployment rate is 4-5%

- There will always be unemployment

- NRU and full employment are the same

Okun's Law: For every 1% increase in the unemployment rate causes a 2% decline in real GDP

Rule of 70: Calculates approximate number of years to double GDP

:max_bytes(150000):strip_icc():format(webp)/Circular-Flow-Model-1-590226cd3df78c5456a6ddf4.jpg)